how to day trade forex: Minimum Capital Required to Start Day Trading Forex

Contents:

With the downside limited to the size of the trade, and the potential payout known in advance, understanding how binary options trading works is not difficult. From a stop loss to a limit order and advanced charting, the trading platform needs to deliver the tools and features you want. Not finding a good trading opportunity sucks, especially when you sit there all morning. Based on swings prior to the first trade I opted for a 14 pip target and 8 pip stop loss. The price is still rallying, and then has a pullback and then pops higher again. When it pulls back again, it pauses at almost the same low, showing very little selling momentum.

- Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

- With a broker, you can set a predetermined action to exit a trade when the market hits this price.

- Discover the range of markets you can trade on – and learn how they work – with IG Academy’s online course.

- Day trading is a short-term style of trading that is popular with many Forex traders.

- Decide what type of orders you’ll use to enter and exit trades.

The massive volume of trades on the forex markets make them very attractive for day traders. There are multiple short-term opportunities in a trending currency pair, and an unrivalled level of liquidity to ensure opening and closing trades is quick and slick. Successful forex day traders typically display a high degree of strategic thinking and discipline in following a well-tested and defined trading strategy to achieve profitable results.

What is Swing Trading vs Intraday Trading?

The seller has an obligation to fulfill the terms of the agreed transaction. Such terms will be to either buy or sell once the buyer decides to ‘exercise’ his option before the expiration date. Anyone with some education and available capital for investing could realistically get into swing trading because of the long time frame of each trade. Day traders often use leverage to enter trades on borrowed funds with the hope of reaping greater profits . Counter trend trading requires experience and mastery of price action and technical analysis techniques.

Finding the top how to day trade forex platform—particularly for day trading forex— is one of the key components to trading forex successfully. A good broker helps you by having a solid user interface, excellent customer service, and the right tools to get you trading productively. Traders must account for how much of your profits will be taken by their brokerage.

How to Trade Within the Market Structure (AUD/USD Forex Example) [Video] – FXStreet

How to Trade Within the Market Structure (AUD/USD Forex Example) .

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

Irrespective of whether you are a complete novice or a seasoned forex trader – demo accounts are one of the best tools you can have by your side. This is because you can day trade forex in real-time market conditions without needing to risk any money. Furthermore, the best forex brokers in this space will allow you to day trade with leverage. This allows you to boost the value of your stake, which in turn, can turn this little profitability into lucrative gains. You do, however, need to ensure that you learn the ins and outs of technical analysis to succeed in the forex day trading scene. Depending on the day trading strategy you select, you might also find that the best conditions for trading tend to occur during certain time frames.

Understanding the Dynamics of the Stock Markets in Intraday Trading

A stop loss of 10 pips below could be a significant amount of money—if one EUR/USD pip costs $10, a 10-pip move downward could cost you $100 on one standard lot. A pip for currency pairs in which the yen is the second currency—called the “quote currency”—is 0.01, equivalent to 1%. Forex pairs trade in units of 1,000 , 10,000 , or 100,000 lots.

The price respected the channel twice at the top and twice at the bottom. Then you see the price only reaches the middle of the channel and then breaks out of the channel. Countertrend trading, you are doing the opposite to trend trading. As you can see, on the bottom left, the price touched support twice before getting back into the trend. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active anytime, with price quotes changing constantly. In addition to knowledge of day trading procedures, day traders need to keep up with the latest stock market news and events that affect stocks. This can include the Federal Reserve System’s interest rate plans, leading indicator announcements, and other economic, business, and financial news. It’s easy to start day trading currencies, because the foreign exchange market is one of the most accessible financial markets.

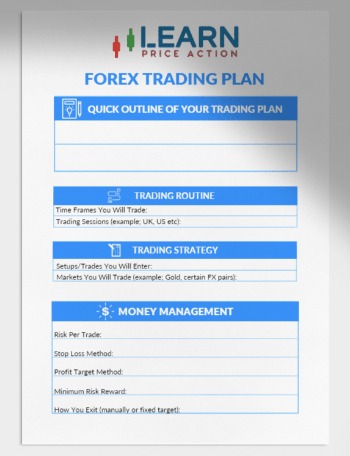

In its most basic form, the RSI – which falls under the umbrella of a momentum indicator, looks to see whether a currency pair is potentially overbought or oversold. A day trader who is using this strategy and is looking to go long will buy around the low price and sell at the high price. While hotkeys are a great way to quickly make a sale, stop orders are excellent when you know when you will exit a trade ahead of time. If you are comfortable with a set range of target prices, you will know exactly when to sell. A trading plan is a way to work out the maximum amount you are willing to win and lose on a trade—by figuring out your margin of risk, you will become a better trader. A lot of new investors will rely on an overall upward or downward trend in the market to generate gains, but there are many kinds of indicators.

How to Day Trade Forex – Quick Guide

Both spreads and commissions are the two main ways that forex brokers can cut into your gains. Slippage occurs when a broker is unable to fulfil an order due to market volatility, and the right broker can help you avoid it. When opening an account for day trading in forex, you will want to consider a broker offering low spreads, low commissions and access to the markets you wish to trade. Their objective is to earn a living from trading commodities, stocks, or currencies via making minor profits multiple times per day.

In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years. This type of trade requires more fundamental analysis skills because it provides a reasoned basis for the trade. Hedging of this kind can be done in the currencyfutures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world. Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps.

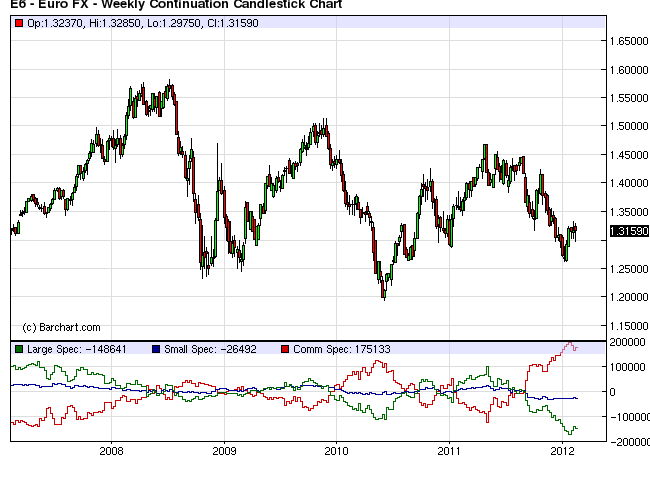

Popular Charts and Indicators for Day Trading

This could, for example, mean being out of the https://g-markets.net/ altogether for extended periods. Sometimes we fall into the trap of thinking that trading profitably, whether in equities, indexes, futures, Forex, options or any other instrument cannot be difficult. Prices can only go up or down and, so long as you can predict the direction correctly more times than you get it wrong, you will be OK. Compared to any other financial market, the forex market has the highest theoretical value of daily trades. How to trade the 5, 10, and 15 minute charts for maximum trading opportunities.

But, those that are experienced in the forex day trading scene know how to handle losses and move on. Price will move within a limited reach over a short time period. As markets usually only move a few points in a session, intraday traders use high risk trading strategies to increase their profit margins.

The past performance of any trading system or methodology is not necessarily indicative of future results. Scalping is a short-term trading strategy that involves building a large trading account through taking smaller profits often. Before you embark on your forex day trading career – be sure to consider the 5 day trader tips below.

What is the best time to trade forex?

If you’re ready to place your first-ever forex day trading position right now – you might want to consider eToro. Benzinga has compiled a list of the five top forex day trading strategies that are described further below. Retail day traders operate at a distinct disadvantage to the first group when milliseconds and dealing spreads really matter. These facts help explain why most retail traders do not operate on a consistently profitable basis over the long term. The second type includes those retail forex traders who operate via online forex brokers and typically use a free trading platform like MetaTrader 4 or 5 (MT4/5).

How to Use Moving Averages for Day Trading Forex – Benzinga

How to Use Moving Averages for Day Trading Forex.

Posted: Tue, 28 Feb 2023 21:25:02 GMT [source]

In general, this is due to unrealistic but common expectations among newcomers to this market. Whether we are talking about forex trading for beginners or stock trading for beginners, many of the basic principles overlap. Experienced traders will attest to the fact that long term success is dependent on constant fine-tuning and improvement.

There is no one-size-fits-all answer to this question – as it depends on a number of factors. For example, this includes the types of pairs you are trading, how much you are staking, what percentage gains you make, and how much leverage you apply. This is because some trader might remain open for several hours while others for just a few minutes. EToro is also home to the previously discussed Copy Trading tool – which again, is ideal for newbies. To recap, this allows you to copy the forex positions of an experienced trader – meaning no research or analysis is need to be performed by yourself. There are no fees to pay when using the eToro Copy Trading tool and the minimum investment is just $500.