What Is the Difference Between a Sales Return & a Sales Allowance? Chron com

Using a sales returns and allowances account helps a business track its returns, leading to the identification of problem products more quickly. Businesses can use either the sales returns and allowances account or sales revenue to record their customer returns. Many companies choose to use a sales returns and allowance account in order to keep a more accurate accounting of their returns and allowances. This involves making journal entries that debit the sales returns and allowances account while also recording a credit in the accounts receivable or cash account. Additionally, if the product is going to be resold, a debit in the inventory account and a credit in the cost of goods sold (COGS) account would also need to be made. If the product was sold for $150 and its inventory value/COGS was $70, the following entries would be made.

- Then, the allowance the customer receives is credited to the company’s accounts receivable.

- Our goal is to deliver the most understandable and comprehensive explanations of climate and finance topics.

- But gradually when the business expands, it becomes inconvenient to record such a large number of transactions in a single book.

- If a customer originally made their purchase on credit, the sale was part of your accounts receivable, which is money owed to you by customers.

- A sales return also happens when you receive the wrong product, e.g., if you purchase a Mac laptop and an HP is shipped to you.

When customers return sales, the company also receives goods back from the customer. Therefore, it must record those goods in the inventory account. It is the second accounting treatment that involves sales returns. Sellers typically grant sales allowances to buyers when merchandise is damaged or defective, the difference between bookkeeping and accounting and the buyer is instructed to keep it. The buyer does not send the merchandise back to the seller but receives a reduction in the total amount that they have to pay the seller for the order. Sales returns are typically granted when defective products are sent back by the buyer to the seller.

A retail store, for example, complains that some of the Christmas ornaments you shipped arrived broken. The parts you shipped to a manufacturer aren’t exactly what they wanted. They don’t want to return the goods, so you offer an allowance. On a $12,000 shipment, you might authorize $1,200 as an allowance. A credit note can be issued when a sales invoice is mistakenly overcharged or when a special discount is given to the customer due to defective goods. A ‘Sales Return Book’ is maintained to record the goods returned by customers to whom sales were made on a credit basis.

Is sales return a debit or credit?

Sales revenue is increasing in credit and decreasing in debit accounts. The sale return account is created for recording the sale that is returning from the customer. It is the contra entries of the sales account, increasing in debit and decreasing in credit. The main reason that is recording in debit while the sales return happened is that this account will decrease the total sale revenue. In each of these cases, the customer is returning the product to receive a refund. When this happens, it is important for businesses to keep track of sales returns so they can update their accounting records.

Electronic Article Surveillance (EAS) Tag Market Size 2023 (New Insights Report) define, describe, and te – Benzinga

Electronic Article Surveillance (EAS) Tag Market Size 2023 (New Insights Report) define, describe, and te.

Posted: Tue, 05 Sep 2023 08:42:24 GMT [source]

First, however, it is crucial to understand what sales returns are. Therefore, sales returns should not cause too much concern for companies. However, it should alarm the business if the sales returns and allowances account is increasing because ultimately, this will result in a decrease in the company’s revenue and income. For the seller, revenue can be revised by debiting the sales return account (A contra account by nature) and crediting cash/accounts receivable with the invoice amount. The sales return account is useful because it helps businesses to track returns and allowances. This is important because it can help businesses to identify problem products.

Closing Entries, Sales, Sales Returns & Allowances in Accounting

Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues. A sales allowance is defined as when a customer is allowed to keep a product without paying for it or without paying the full amount owed for the entire purchase price. In each of these cases, the buyer is still allowed to keep the product, and they are not required to pay or continue paying for it.

This includes giving the customer back their money and updating the accounting records. When a customer buys something for you, you (should) record the transaction in your books by making a sales journal entry. So, when a customer returns something to you, you need to reverse these accounts through debits and credits. A sales return policy is essential in ensuring customers of the quality of the goods delivered. Some companies may also offer a sales allowance policy, which is similar to accounting treatment. For example, suppose you deliver an $860 order to one of your regular customers.

Sellers do this when they need to juice cash flow or decide accounts receivable is too high. When the business is small, it is easy to record every transaction in a single book called ‘Journal’. But gradually when the business expands, it becomes inconvenient to record such a large number of transactions in a single book.

Describe Product Features Accurately

If it is a cash sale, the sale return is recorded in the Sales Returns account and also as a debit to the cash sales account. If the sale is a credit sale, then the sales return will be recorded in the Sales Returns account. It is a credit to the account receivables because it reduces the total amount of the account receivables. Some companies do not use the intermediary sales return account because it is a contra account – meaning that it is just a deduction from another account. To reverse the return’s related revenue, you have to debit your sales returns and allowances account by the amount of revenue generated by the original sale. Then, you have to credit your accounts receivable or cash account by the same figure.

- In the context of returns and allowances, it means expanding your returns and allowances account.

- Once you get the hang of which accounts to increase and decrease, you can record purchase returns and allowances in your books.

- In these cases, the merchandise is physically returned to the seller, who either refunds the buyer’s money or gives the buyer a credit to use toward future purchases.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- Nurture and grow your business with customer relationship management software.

A sales return is an item that was sold to a customer but was later returned to the business. This can be due to various reasons such as the item being defective, the customer not being satisfied with the item, or the customer returning the item for a refund. As a result, Red Co. received $10,000 worth of electronics back from customers. However, none of the customers had paid for those goods at the time.

How to Record Sales Returns and Allowances

Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

In some cases, companies may offer goods in exchange for any returns. Normally sales returns and allowances are two different kinds of transactions. Still, the accounting treatment for both the transactions is the same, and mostly the same account is used to record both types of transactions. The product was not defective and can be resold, so it will be returned to inventory.

No matter how great your products are, you’re bound to have purchase returns at some point or another. Sales Return Book is also known as ‘Return Inward Book’ or ‘Sales Return Journal’. Sometimes, trade discount is also provided to the customers on credit sales.

They are a reduction of sales revenue and are therefore deducted from sales revenue when calculating net sales. A sales return is an adjustment to sales that arises from actual return by a customer of merchandise he/she previously bought from the business. It is commonly recorded under the account “Sales Returns and Allowances”. A seller can more closely control the amount of sales returns by requiring a sales return authorization number before its receiving department will accept a return. Otherwise, some customers will return goods with impunity, some of which may be damaged and which can therefore not be re-sold.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Nurture and grow your business with customer relationship management software.

The Return on Sales (ROS) is a percentage measure, used to indicate how efficiently a business transforms sales into profits, e.g. the amount of profit generated per dollar earned. Upon receiving the machine and realizing how outrageously impractical their impulse buy was, they sent it back. For instance, let’s say there’s a company that manufactures automatic electric hard-boiled egg-making machines.

If so, there will be an excessive amount of revenue recognized in the original reporting period, with the offsetting sales reduction appearing in a later reporting period. This overstates profits in the first period and understates profits in the later period. Use the Ship-From Sales Return process when you ship merchandise that is returned to you before the buyer receives it. You must print a nota fiscal to account for this type of transaction. To update your inventory, debit your Inventory account to reflect the increase in assets.

Bookkeeper Job Description, Skills, Experience and Education

Content

An Accounts Payable Specialist works closely with the accounts payable clerk to monitor outgoing payments from an organization. An Accounts Payable Specialist also assists in keeping track of vendor payment agreements and logs outgoing invoices. An Accounts Payable Specialist reviews and reconciles reports within the payables department. A Senior Accountant is responsible for reviewing journal entries of junior accountants and making recommendations based on their analysis.

- A bookkeeper (also known as a bookkeeping clerk) is a professional who helps businesses and other organizations keep their finances in order.

- For example, note which software you want a candidate to be familiar with–including general programs that your office uses.

- Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content.

- The common person knows that cyber security and cybersecurity are one in the same.

A Controller ensures that all financial reports are accurate and interprets data that is shared with executives of a company. A director or above position on most accounting teams the Controller is also tasked with keeping the business in compliance with financial laws and regulations. A Controller is the same position as Comptroller with Comptroller more commonly used in government and non-profit organizations. Below are the most popular entry-level accounting job titles ranked by both candidate and employer searches on Google (source; ahrefs and Google Keyword Planner). As an alternative to accounting, bookkeeping is an appealing field for professionals who want to work with financial statements and computers.

Social Media Coordinator

This is another chance to sell potential applicants on things like telecommuting, work-from-home options, or additional availability during tax season. Benefits that can set your firm apart, like paid https://www.bookstime.com/articles/inventory-accounting vacation time, conference sponsorships, or childcare reimbursements can go right here. As you prepare your bookkeeper job description, salary range transparency is an important consideration.

- Today, many use Pacioli’s core bookkeeping and accounting principles to streamline business finances.

- On Bookkeeper resumes, you should include examples that show you’re comfortable dealing with a range of finance responsibilities, from reporting to automating tasks.

- A Social Media Coordinator also frequently interacts with fans or followers and measures social media engagement.

- Blockchain Developer is the top searched-for job by candidates and also the most requested cryptocurrency job description by employers.

- The size of your organization and the product you provide steers what qualifies as a warehouse job and who leads the team.

- Whether you are already in the bookkeeping field or just starting out, this guide can help you determine your next steps.

Bookkeepers process and record transactions and financial decisions, monitor and record sales, payroll, invoices, accounts receivable, accounts payable, and more. Often, their work – “the book” – will be the central ledger for a company and will be used to make decisions when the upper management needs data to drive their decisions. They are the head of the accounting department’s day-to-day operations. They oversee financial methods and transactions, ensure compliance from the company’s accountants and lower-level financial employees, and enforce financial policies. They are often less senior than Directors, VPs, and C-levels but may also be the top-level financial or accounting officer. The chief financial officer is the top-level employee in charge of all things finance.

Bookkeeper responsibilities

Professionals must complete 24 hours of approved continuing professional education each year. A majority of professional certifications expire periodically and require renewal. Professionals looking to brush up on bookkeeping fundamentals can enroll in this introductory course from edX. Free, self-paced, and designed for part-time completion in six weeks, edX’s course covers topics including banking processes, payroll, ledger accounts, and reconciliations. The Association of Chartered Certified Accountants developed this course. When you register for the CB exam, consider adding a few of AIPB’s official workbooks to your order form.

At the lowest level of the corporate ladder is the accounting intern. Interns may be college students or fresh graduates, working with a company for little or no pay bookkeeper synonym to build experience, earn college credits, or otherwise get a foot in the door. Accounts Payable Clerks are a form of clerk more commonly seen in large enterprises.

Income Tax Calculator 2022-2023: Estimate Your Taxes

Content

The median family income in many of the state’s suburbs was nearly twice that of families living in urban areas. Governor Lowell Weicker’s administration imposed a personal income tax to address the inequities of the sales tax system, and implemented a program to modify state funding formulas so that urban communities received a larger share. The twin revenue-raising successes of Wisconsin’s 1911 (the Wisconsin Income Tax, the first “modern” State Income Tax was passed in 1911 and came into effect in 1912) and the United States’ 1914 income taxes prompted imitation. Many states’ constitutions were interpreted as barring direct income taxation, and franchise taxes were seen as legal ways to evade these bars. The term “franchise tax” has nothing to do with the voting franchise, and franchise taxes only apply to individuals insofar as they do business. Note that some states actually levy both corporate net income taxes and corporate franchise taxes based on net income.

How much is 175k after taxes in California?

If you make $175,000 a year living in the region of California, USA, you will be taxed $60,094. That means that your net pay will be $114,906 per year, or $9,575 per month.

If this is your fstates by income tax ratet year filing a SC return after being assigned an ITIN, be sure to include a copy of the ITIN letter received from the Internal Revenue Service . DOVerify the mailing address is complete and accurate on the return. Generally, it should match the filing status marked on your federal return.

Corporate Income Tax Rates

The phaseout range for the standard deduction, personal exemption, and dependency exemption is $233,750 to $260,550. For taxpayers with modified Federal AGI exceeding $260,550, no standard deduction, personal exemption, or dependency exemption is available. Montana filers’ standard deduction is 20 percent of AGI.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Just answer simple questions, and we’ll guide you through filing your taxes with confidence. Whichever way you choose, get your maximum refund guaranteed.

Alternative minimum tax (AMT)

The tax will be reduced by 0.2 percentage points per year. The initial reduction from 6.84 to 6.64 percent occurred on January 1, 2023. 1 to convert the individual income tax structure to a flat rate of 5.8 percent, down from a top marginal rate of 6 percent. As this law was designed in part to supersede a tax increase proposal that was approved for the ballot but later withdrawn, the law technically took effect January 3, 2023, but its provisions apply retroactively to January 1, 2023.

Which states have no state income tax?

Nine states — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming — have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation.

Few states impose an income tax at rates that exceed 10%. The maximum federal income tax rate on ‘qualified dividends’ received from a domestic corporation is 20%. The maximum federal tax rate on capital gains is 20% for assets held for more than 12 months. The graduated rates of tax apply to capital gains from assets held for 12 months or less. If you had $50,000 of taxable income, you’d pay 10% on that first $10,275 and 12% on the chunk of income between $10,276 and $41,775. And then you’d pay 22% on the rest because some of your $50,000 of taxable income falls into the 22% tax bracket.

Federal sales tax deduction for tax year 2018

In addition to the personal income tax rates, Delaware imposes a tax on lump-sum distributions. Federal income taxes are collected by the federal government, while state income taxes are collected by the individual state where a taxpayer lives and earns income. (It can get complicated if you live in one state and work in another, which happened more frequently during the pandemic.) There are seven federal tax brackets, ranging from 10% to 37%, depending on your income and filing status. The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption.

The Trial Balance

Content

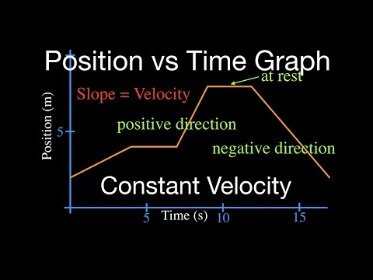

When asking “What is normal balance,” it’s worth taking the time to also look at contra accounts. The accounts’ normal balance is among the most important forms of accounting. Investors and business owners can use the normal balance to determine the financial situation https://www.bookstime.com/articles/remote-bookkeeping of a company, including how much debt the business has and how many properties it owns. Below is a basic example of a debit and credit journal entry within a general ledger. Debits and credits differ in accounting in comparison to what bank users most commonly see.

If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss. You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575.

Statement of Retained Earnings

After double‐checking each column’s total to make sure the problem is not simply an addition error on the trial balance, find the difference between the debit and credit balance totals. If the number 2 divides evenly into this difference, look for an account balance that equals half the difference and that incorrectly appears in the column with the larger total. If the Greener Landscape Group’s $50 accounts payable balance were mistakenly put in the debit column, for example, total debits would be $100 greater than total credits on the trial balance. Looking at the income statement columns, we see that all revenue and expense accounts are listed in either the debit or credit column.

When an account has a balance that is opposite the expected normal balance of that account, the account is said to have an abnormal balance. For example, if an asset account which is expected to have a debit balance, shows a credit balance, then this is considered to be an abnormal balance. For reference, the chart below sets out the type, side of the accounting equation (AE), and the normal balance of normal balance of accounts some typical accounts found within a small business bookkeeping system. Because these have the opposite effect on the complementary accounts, ultimately the credits and debits equal one another and demonstrate that the accounts are balanced. Every transaction can be described using the debit/credit format, and books must be kept in balance so that every debit is matched with a corresponding credit.

How to Calculate Credit and Debit Balances in a General Ledger

US GAAP has no requirement for reporting prior periods, but the SEC requires that companies present one prior period for the Balance Sheet and three prior periods for the Income Statement. Under both IFRS and US GAAP, companies can report more than the minimum requirements. Ending retained earnings information is taken from the statement of retained earnings, and asset, liability, and common stock information is taken from the adjusted trial balance as follows. These contra accounts are accounts that are offset against another account. For example, you may find a contra expense account, which covers things like purchase returns.

This meant they would review statements to make sure they aligned with GAAP principles, assumptions, and concepts, among other things. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit. In Completing the Accounting Cycle, we continue our discussion of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a post-closing trial balance.

Property Tax Calculator City of Orlando

Content

All https://quick-bookkeeping.net/ products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. A tax lien is a legal claim against property or financial assets you own or may have coming to you. If you sell the asset, the government could be entitled to some or all of the proceeds.

The Recorder/Surveyor’s Office records the boundaries and ownership of each property in the county. The Assessor’s Office estimates the fair market value of each property. The Clerk/Auditor’s Office calculates the property tax rate based on budget requirements and the total taxable value determined by the Assessor’s Office.

Apply Your Municipality’s Millage Rate

This figure includes all real estate, income, and sales taxes on the property. This calculator is a tool to assist in providing a rough estimate of “uncapped” property taxes. You may enter a purchase price or an opinion of value along with the appropriate school district. The Clerk/Auditor is also responsible for mailing the initial notice of value and receiving appeals of value. The Treasurer’s Office sends out the final tax bill, receives property tax payments, and distributes the funds to the various taxing entities.

- Prior to becoming an editor, she covered small business and taxes at NerdWallet.

- Hawaii had the lowest rate, at just 0.31%, followed closely by Alabama at 0.39% and Louisiana at 0.54%.

- These amounts can be found on the right-hand side of your bill in the third section of itemized amounts.

- For example, for 2020 taxes you would select the “2020 Tax Rates ” document on this page.

- The data contained in the calculator represents only one way of looking at city finances and budgets.

The information on this page will help you understand how your taxes are calculated and answer frequently asked questions about property taxes in Multnomah County. Visit the Property Assessment page to get information about how we determine the value of your home. In the tax year after the end of the disaster calculation time period, the taxing unit must calculate its emergency revenue rate and reduce its voter-approval tax rate for that year. The chief appraiser must give taxing units a list of taxable properties that the chief appraiser knows about, but that are not included on the certified appraisal roll or in the certified estimate. These properties are not on the list of properties that are still under protest.27 The taxing unit adds the value of properties known, but not appraised for the current year.

How to calculate property tax rates

Then, the value is multiplied by the assessment rate, which varies by jurisdiction and represents the percentage of a property on which taxes are due. However, if your Class 2 property is assessed at, for example, $5,500,000, your tax is computed using the $1.77 tax rate. That product is $97,350, which is the annual tax on the property’s $5,500,000 assessment.

What’s at stake for Jordan’s School Referendum Jordan – SW News Media

What’s at stake for Jordan’s School Referendum Jordan.

Posted: Wed, 15 Mar 2023 17:00:00 GMT [source]

Property taxes, like income taxes, are nonnegotiable, meaning you have to pay them. If you don’t, you put yourself at risk of mortgage liens or foreclosure. If you’re allowed and choose to pay your taxes yourself, you will pay them in full when they become due. Like we said earlier, some areas allow you to make quarterly or semi-annual payments to decrease the amount you’ll pay at once.

John Ulibarri, AAS, RES County Assessor

Here are the most common property tax exemptions, but check with your local government to see what options you have. Below is a general overview of how real estate taxes are calculated. If you’re trying to pay property tax online, find tax records, or wondering how much the tax is in your area, check out your home county’s tax assessor website. Most property tax assessments are done either annually or every five years, depending on the community where the property is located. After the owner has received their assessment with its property valuation, a property tax bill is mailed separately.

Make sure the assessment data is accurate and matches the details of your property. Write a check or pay online once a year, every six months or quarterly when the bill comes from the taxing authority. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Find The Assessed Value Of The Property

These tax shifts will affect different properties in different ways. Tax rates are comprised of individual rates for the different taxing jurisdictions in your Levy Code Area. The Levy Code Area number can be found at the top middle of your tax bill between the legal description and account number. Your Assessed Value is multiplied by the tax rate for your code area, and any Special Assessments are added. TCAs are geographical areas covered by different combinations of tax levies.

How property tax is count?

The property tax is calculated by multiplying the Annual Value (AV) of the property with the prevailing property tax rate. Every property has an AV. This AV of a property is determined based on market rentals of similar or comparable properties.

If your commercial Property Tax Calculator & How Property Tax Works is classified as Class 2, and your property is assessed at a total value of $5,000,000 or less, your tax rate is $1.65. If your property’s assessed value is exactly $5,000,000, divide that value by 100; the amount is $50,000. The property tax search is provided as a public service for your convenience. For official copies of documents, please visit the Bernalillo County Assessor’s/Treasurer’s office. You can make comparisons over time for a given city to see the changes in taxes owed to the city and to all local jurisdictions.

Required Applications:

Additional details on the Assessment Rate and Mill Levy are below. Seniors and disabled veterans may qualify for certain property tax exemptions. The numbers above are only an estimate of the tax you will owe if the tax rate remains the same. Multiply the taxable value of your property by the current tax rate for your property’s tax class. Some localities collect them annually, while others require payments quarterly or annually. This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000.

How do you calculate real property tax on a house?

The formula to compute real estate tax is REAL ESTATE TAX = REAL ESTATE RATE X ASSESSED VALUE OF THE PROPERTY. The assessed value of the property is defined by its fair market value multiplied by the assessment level fixed through ordinances. The assessed value may be defined as the property's taxable value.

Aim to show that homes with similar tax values are better than yours. If you disagree with a property tax bill on your home, you can contest it by challenging your home’s assessed valuation. You’ll need to show that the assessed value doesn’t reflect your property’s true value. If successful, your appeal could result in a lower property tax bill. Some taxing authorities apply the tax rate only to a portion of the home value rather than to the full home value. Your property tax bill is mostly based on your property’s location and value.

Vertical Analysis Profit Loss, P&L, Income Statement 3060 QuickBooks Pro Plus Desktop 2022

Contents:

If you’re creating your QuickBooks income statement for tax- or loan-application purposes, ask your tax advisor or business loan officer which basis they need. What is what is the other types of business cost of goods sold In comparison as a ratio to what they’re trying to do generate revenue, what is that percentage look like? How about the rest of their expenses in relation to basically the revenue generation?

If you don’t have an https://bookkeeping-reviews.com/, QuickBooks gives you the option to sign up for a 30-day free trial or 50% off for three months. Thus, after considering all non-operating income and expenses, we are left with net income which forms part of the retained earnings in the balance sheet. The next part of the income statement calculates income from business operations. Income from business operations takes into account net other income or expenses like interest expense and taxes to determine net income from business operations. The total operating expenses of Microsoft in 2020 are calculated by adding SG&A expenses worth $43.98 billion and other operating expenses worth NIL. Thus, operating income is calculated by subtracting operating expenses of $43.98 billion from the total revenue of $143.02 billion, which turns out to be $99.04 billion.

QuickBooks for Small Business Review 2022 – Nav

QuickBooks for Small Business Review 2022.

Posted: Wed, 08 Feb 2023 08:00:00 GMT [source]

50+ ways to increase website traffic find that there are numerous benefits to using QuickBooks’ bill-paying features, such as an improved credit rating, a dearth of past-due notices, and better cash flow. Once you’ve paid a bill, your Accounts Payable and checkbook balances decrease, and the vendor balance and reports are updated. QuickBooks stamps a PAID watermark on the bill to avoid confusion later on.

How to Display Text in Two Lines With Crystal Reports

In this case, $30,953.20/$51,241.16 shows a gross profit margin of 60.4%. Very often the answer is ‘it depends’, which is why you should try to compare yourself to similar companies in your industry. Although ratios may have made you drowsy during accounting class, they can be a fascinating way to measure your company’s financial performance. From there, click the Discrepancy Report button to display the report, as shown in Figure 4. This identifies any edited or deleted transactions that may affect your reconciliation.

Such an income statement helps to understand and compare the financial performance of the business entity over different accounting periods. Income statement reveals your business’s performance over a period of time. Thus, after determining the operating income, you need to assess non-operating income and expenses. Simply find out these items on the trial balance and include them in the income statement as non-operating income, expense, and others just below the operating income. Are the expenses incurred by your business in order to run its normal course of operations such as payroll, rent, office supplies, etc. Thus, you need to add all the operating expenses specified in the trial balance report and enter the same expenses in the income statement as selling and administration expenses.

How to Customize Financial Reports in QuickBooks

In the end, You can do save, Print, or also send it from your QuickBooks account whether it is Online or Desktop. For any queries, Issues, or Problems, Just get in touch with the experts team via LIVE CHAT. You have to click on the email button from the top right side of the screen. Then a window opens up on your screen in which you can write the own message you want to send with this report. Your report is sent using email according to the preferences you have selected for Send Forms.

It shows the stability and growth of your company over time. Now let’s go back to the main profit and loss report and see how ambiguity can make your life a little tougher than it needs to be. You’ll see that we have an account called “miscellaneous” with $2,666 in it. Your accounting system isn’t just used to give you a bottom line at the end of the year – it’s meant to aid your business decisions.

What are the Main things for Customizing Report while Creating QuickBooks Income Statement?

There are transactions included in the profit and loss report that do not use items. QuickBooks profit and loss report wrong happens when discrepancies occur in transactions. You may see incorrect amounts, totals, etc., for various reasons mentioned in the section below. These reasons can interfere with the credibility of QB applications to generate credible reports.

Accounting for employee retention credits – Journal of Accountancy

Accounting for employee retention credits.

Posted: Fri, 06 May 2022 07:00:00 GMT [source]

If Location or Class doesn’t appear in your Filter options, you need to turn on Class and Location tracking, as illustrated in Step 4 of our tutorial on how to set up advanced settings. In the profit and loss report, you can find the option memorize at the top of the report. This option is also available after customizing the income statement into your account. There are two bases on which the statement can be created. These two bases are accrual or cash basis income statements. It shows you the expense that you have paid and the income that you have received.

Step 4: Create your Income Statement into QuickBooks Account

Users on the Essentials plan get quite a few other reports, including Vendor Balance Detail and Summary. The Plus plan comes with about a dozen additional reports. Accountant reports are something you may often want to export out of the platform – for further processing or to keep in your records. There are 19 reports available in the Payroll category, right at the bottom of the Reports page. Those of you on Smart Start and Essentials plans can access nearly all of them without any restrictions.

The net income figure on your P&L won’t give you the full details on why your cash balance decreased, but the Statement of Cash Flows will. To do so, choose Reports, Company & Financial, and then Statement of Cash Flows. Any of these links will display an online from in your web browser so that you can submit your thoughts directly to the QuickBooks development team. QuickBooks frequently updates its’ products, so before you send a bug report, choose Help, and then Update QuickBooks. Click the Update Now button to ensure that you have the latest patches and fixes for your version of QuickBooks. When QuickBooks displays the 12-month report, as shown in Figure 4, click the Export button, and then click OK to send the report to Microsoft Excel.

Once you’re familiar with the reporting structure, you can begin to explore ways to create more custom reports. Because QuickBooks Desktop reports use report templates, it’s important to set all of your preferences before creating a custom report. However, there are various ways that you can use existing report templates to create a more custom QuickBooks bookkeeping or accounting report.

For instance, your net income is reduced by materials used in a particular job, even if you haven’t paid for the materials yet. This provides a much better matching of revenue and expenses than looking at cash flow. Click on the option customize report from the top left side of the income statement screen to customize your report more specifically with many other options.

What happens when a business needs to record a transaction in QuickBooks, but can’t find a matching account name in the chart of accounts? QuickBooks allows you to make up a new account name which you think better fits the transaction description. Unfortunately, this practice tends to spiral out of control. We’ll explain some of the dire consequences of an improperly maintained chart of accounts, but first, let’s review what makes up a chart of accounts. Net income can be understated on the P&L when users create a check using the “Write Checks” feature rather than clicking “Pay Bills” and creating the check in the “Pay Bills” window.

Three Essential Financial Statements for the Financial Reporting

Run the report on Accrual basis and then double-click the account to zoom in. Now verify that each sales item is pointing towards the correct account. Compare the reports again to check if you are still getting an incorrect Profit and Loss Report. Open reports in QuickBooks Desktop and select Customize Reports. You are selecting a different date range for both of the reports.

When you return to the Profit and Loss by Class report, refresh and you’ll see that the previously unclassified item has been moved to its designated class. It’s a good idea to clean up all your unclassified transactions at the end of the month. Accounting software does more than record your accounting information; it helps to make sure that your company stays on a healthy financial level. It has become a trend that any business who decide to stop using the excel spreadsheets opt for the QuickBooks Instead. However, there are other alternatives which give you the same service and at a lower price. The FreshBooks is one such alternative; it is effortless to use, affordable and gives you access to the top of notch services.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

Are we in alignment proportionally to the same kind of structure? Let’s go through the formatting that we can typically do in this type of report now. So if I go back up top, we might want to change say, the profit and loss, let’s kind of change that to an income statement just to practice that change. If your balance sheet is not accurate it is most likely that your profit and loss statement will be wrong also.

Software for Accountants

Content

Reply to client reviews directly to shape your brand and leave a lasting impression. Self-paced lessons help grow your knowledge and skills to advise your clients. Automatically identify and resolve common bookkeeping issues so the books are closed accurately and on time.

What are 4 options you can access via accountant tools in QuickBooks Online?

- Reclassify transactions: Edit or move multiple transactions at once.

- Write off invoices: Cancel and zero-out bad invoices that won't get paid.

- Undo reconciliations: Reset a reconciliation and start over fresh.

- Reporting tools: Set default date ranges and filters for financial reports.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. When it comes to cost, Wave is the winner with a zero-dollar fee for the basic service. Sage Business Cloud Accounting will review your business needs before giving you a quote, whereas QuickBooks Online Accounting is a per-client charge that is easy to understand. Accountants love the Accountant Toolbox that puts everything at their fingertips.

Quickbooks Online Accountant Review (

You can also create custom rules so expenses are properly sorted in the system. For example, you can create custom rules to categorize tax-deductible expenses separately from nondeductible expenses, thus making it even easier to review your deductions at tax time. When you’ve decided on a plan, you will be able to access the QuickBooks dashboard, where you can connect and manage your accounts. The process is seamless, and question prompts guide you while you enter your financial information.

QuickBooks Enterprise has some inventory management functionality, but it’s fairly limited overall and relies on third-party integrations for advanced features. Detailed reporting may require exporting spreadsheets and viewing data in and across multiple platforms. As previously mentioned, there are four QuickBooks plans to decide from when you’re choosing the best accounting software for your business — Simple Start, Essentials, Plus, and Advanced. No matter which plan you end up going with, luckily, all plans automatically include everyday customer phone support and 24/7 chat support, as well as access to QuickBooks mobile apps and third-party app integration.

Does QuickBooks Online provide live bookkeeping support?

Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content. Fit Small Business content and reviews are editorially independent. Only one QBOA user may enroll the QBOA firm in the Revenue Share Program. Easily reference shared notes, documents, and client information in your client list. 93% agree they are more confident serving their clients as a certified QuickBooks ProAdvisor.

Roundtable Transcript: What’s Next in Business Technology? – businessjournaldaily.com

Roundtable Transcript: What’s Next in Business Technology?.

Posted: Mon, 27 Feb 2023 10:02:33 GMT [source]

Alternatively, you can manually enter your mileage each Quickbooks Online Accountant, Grow And Manage Your Firm you drive. In the “Your Practice” section, you’ll have access to built-in tools for workflow tracking, document sharing, and team assignments. This enables you to streamline your communications by sharing client documents and keeping them organized in a password-protected environment. Once you complete the training, pass the exam, and become a QuickBooks ProAdvisor, you’re eligible to list your profile for free in the Find-a-ProAdvisor Directory.

QuickBooks Online Review 2023: Pros, Cons, Alternatives

It’s easy to keep thorough, detailed records with QuickBooks Online. When you’re adding an expense, for example, you have the option of adding reference numbers, permit numbers, attachments and memos. You can also split the expense into multiple categories or items.

Bookkeeping for Property Management: 8 Best Practices

Content

Keeping a balance sheet updated would be more work than it’s worth for these little units. You recognize revenue for all rents received and expenses for maintenance, landscaping, and other cash outflows. Here are the accounting best practices that will help transform your property management business into a lean, mean, profit-building machine. Tasks that take hours to complete each week or each month can be automated to be completed instantly, with greater accuracy and more thoroughly. The time saved by not doing manual accounting can be better used to manage the human elements of property management, like dealing with tenants. Operating costs are the day-to-day costs required to maintain and manage your property.

Schedule a free Demo with DoorLoop today and bring ease and efficiency to your property management accounting. There’s a lot involved in getting your property management accounting up and running. Try Total Management if you want a property accounting software built for commercial property that’s easy to use, and you have the budget to spend on a premium solution. With QuickBooks, it’s hard to work using multiple accounts, such as property management, business management, and deposits.

Tax Deductions

Since that is often not possible, Plan B is extensive collaboration between accounting, operations, and IT. The mission of that group is to develop a reliable way to get accurate data from the operations software to the accounting software. It could be an automated process that ensures nothing is falling through the cracks. It is the policy of the NARPM® to comply fully with all antitrust laws.

- This type of bookkeeping is the go-to option for a smaller property management accounting system.

- Finally, though it does not happen often, members of a development do have the ability to take legal action against a board for mismanagement.

- Variance analysis is a systematic approach to the comparison of the actual and budgeted costs of the raw materials and labour used during a production period.

- The major lack was a good job costing system to show the true cost of each manufactured product.

- Through this practice, stakeholders can stay abreast of their profits and losses while increasing chances for improved performance over time.

The good news is that hotel accounting software can make everything we’ve discussed so far much simpler. As mentioned, accounting for hotels can be unique and varied since hotels can have many different departments with different accounts and different transactions taking place. If your property is going to run smoothly month-to-month and year-to-year, your finances have to be in order. Without quality accounting, law firm bookkeeping it will be very difficult for your hotel to achieve a successful revenue management strategy or sustainable business. Whether you seek to outsource your entire accounting department or the accounting for a single property, real estate client accounting services could be right for you. Our advisors will work with you to create a customized solution that meets your needs and scales with you as you grow.

Lean accounting (accounting for lean enterprise)

Consistent with other roles in modern corporations, management accountants have a dual reporting relationship. All “real” financial activity takes place in the accounting software. Customer invoices and payments, vendor bills and payments, payroll, etc. happen on the accounting side. The chart of accounts will list the financial accounts that are set up for your hotel. It’s a way of documenting what records you keep and track to ensure the health of your business.

Accounting for your rental properties doesn’t have to be this stressful. Read on to learn how to set up a system for your property management accounting. With property management accounting software, you get much more than just robust accounting features.

P&L statements quarterly

The Modified Accrual Basis method is unique because revenues are recorded as soon as they are earned, but expenses are only recorded when payment has been made. In this case, accounts like assessments receivable and prepaid assessments will appear on the balance sheet, but liability accounts such as accounts payable will not appear. Like the Cash Basis, this method can only be used for interim or unofficial reporting. The good news is board members don’t have to try to figure things out on their own. HOAs have the option to hire a professional, such as an HOA management company that specializes in finances, or a certified accountant, to help them maintain the financial health of their community.

If you have the money spent before it clears, you can harm your own cash flow. Creating a system for accurate reporting is essential for any organization. All financial information should be tracked, inventoried, and stored securely, with multiple layers of verification available to confirm the accuracy of the reports. It is essential to have measures that identify potential errors early on and provide an avenue for swiftly making any corrections.

Therefore, investors should find the most efficient ways to automate their accounting needs. As such, it’s important to understand these requirements to ensure accurate reporting while avoiding fines or other mistakes caused by not staying informed. Researching regulations pertaining specifically to your area can help you remain compliant while protecting yourself financially and otherwise when engaging in real estate transactions moving forward.

Because of this, it tends to be the accounting method that most sole proprietors choose to use. However, that’s not the only reason you want to keep your personal and business accounts separate. If a lender or auditor needs financial statements from you, they’ll typically specify which report they need. FreshBooks can save you the money you’d waste on an in-house accountant.

4 Ways to Account for Tenant Improvements

Contents:

As fixed assets, leasehold improvements can also be depreciated or amortized. Leasehold improvements provided by the landlord would be depreciated in the same way other assets are. However, leasehold improvements completed by a tenant would be amortized rather than depreciated.

Work carried out when an asset “breaks” or before, so long as the work is carried out to restore the asset to the original condition. This includes action taken to prevent further deterioration and to replace or substitute a component at the end of its “useful life”. A maintenance task cannot be deemed a repair if it improves upon that original condition.

Leasehold Improvement: Definition, Accounting, and Examples

This can range from machinery and vehicles to any other fixed item used in a business’s operational quest for revenue. It is important to keep a record of fixed assets purchased, as the tax implications may be different for working assets. Leasehold improvements, also called “build out” expenses, are improvements made to space rented for your business that will be used exclusively by your business. Leasehold improvements can be minor changes, such as painting or flooring, or major changes, such as constructing, moving or removing walls.

Using the Settlement Statement to set up your new building in QuickBooks provides almost a “cheat sheet” for entering the transaction. We will use the Settlement Statement below as our example for building the Journal Entry in QuickBooks. Landlords need to carefully consider how they categorize maintenance work.

He has a BBA in Industrial Management from the University of Texas at Austin. Up to 20 reports can be printed, including asset schedules by G/L account, location, and category. Depreciation can be computed for up to six asset bases, including tax and book.

Even though many leasehold improvements are actually tangible assets, such as carpeting or cabinetry, the tenant records the expense for these improvements with amortization. Since the landlord retains ownership of the improvements at the end of the lease, there is no salvage value for the tenant. Therefore, the leasehold improvements are treated as intangible assets and accounted for with amortization. Afixed asset can be considered a tangible item that a business owns and uses to generate income.

A capital improvement is a durable lasting upgrade, adaptation, or enhancement of the property which significantly increases the value of the property. The owner of Store A decides to lease space through Company B. The store only has four walls and no other amenities. Through the lease negotiation, Company B—the landlord—agrees to install shelving, a service counter for cash registers, and a display unit with special lighting before Store A opens its doors. The Coronavirus Aid, Relief, and Economic Security Act made some tweaks to qualified improvement property when it was passed in 2020. The act put a 15-year recovery period for QIP and allowed filers to claim first-year depreciation for any QIP. When you go to ‘write checks’ from the banking menu, you can see two tabs under ‘memo’ box – one is ‘expenses’ and the other is ‘items’.

Property Assessed Clean Energy (PACE) Loan Definition – Investopedia

Property Assessed Clean Energy (PACE) Loan Definition.

Posted: Sun, 26 Mar 2017 11:05:02 GMT [source]

These plain english accountings often pay for costs incurred when a tenant moves to the new property, such as updating floors or windows. Several expenses normally deductible on an investor’s Schedule E frequently appear on the closing statement. These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance.

How much is the typical tenant improvement allowance?

In the From QuickBooks tab, you need to click on “Automatically” when QuickBooks Fixed Asset Manager opens and both new and modified fixed asset items. One easy way to work with your accountant is by using anAccountant’s Copy, which QuickBooks Desktop will produce for you. You can save the accountant’s file locally and share it electronically using a file transfer service. Then, your accountant can review and make changes directly to the accountant copy data, which then can be incorporated into your company file. As an alternative, your accountant can use the Send Journal Entries feature if they’re using an accountant’s version of QuickBooks.

The following table summarizes many of the factual considerations used by the courts. These factors, although not exhaustive, should be considered in your analysis to distinguish between capital expenditures and deductible repairs. 2.) Depreciation Expense realizes the depreciation expense of the asset to your business’s profit & loss.

How to Deal with Fixed-Asset Accounting for an Insurance Claim

Input the account’s name, then tick the Track depreciation of this asset checkbox. They are also subject to wear & tear , which decreases their value over time. It’s a relatively permanent resource of a company used in business operations to generate income, unlike parts of the inventory for reselling. QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

Record the depreciation for the year as an increase to the leasehold improvements accumulated depreciation account. If you are not certain how to record capital improvements or calculate depreciation, hire an accounting professional to assist you. Purchase depreciation calculation software for easy calculation of annual depreciation expense for all fixed assets.

In this case, the https://bookkeeping-reviews.com/ of the lease would be 10 years, and the useful life of the equipment is still seven years. The proposed regulations require capitalization of amounts paid to acquire, produce, or improve tangible real and personal property, including amounts paid to facilitate the acquisition of tangible property. Also the new regulations will allow the dispositions of component parts of a building resulting in the recognition of a gain or loss upon the retirement of such component.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

Technically, you are amortizing leasehold improvements rather than depreciating them. The reason is that the landlord owns the improvements, so you are only exercising an intangible right to use the improvements during the term of the lease – and intangible assets are amortized, not depreciated. That’s why businesses periodically transfer a capitalized cost’s portion on the balance sheet to an expense on the income statement. The best way to record the purchase of a fixed asset in QuickBooks is to use the closing documents from the sale. It is often called a HUD statement (because the U.S. Department requires it of Housing and Urban Development). Whatever you call it, what you need for accounting purposes is the breakdown of any money transferred during the transaction.

Are the repairs at your rental property an Expense or a Capital Improvement?

Tenant improvements are treated as ordinary capital expenditures on the landlord’s financial statements.The total amount of the expenditures are recorded as an asset on the landlord’s balance sheet. Then, each month, the depreciation expense is recorded on the landlord’s income statements. Capital improvements are improvements made to real property, such as an office building, that extend the useful life of the object for more than 1 year. The Internal Revenue Service sets forth guidelines for classifying items as capital improvements versus repairs and maintenance. Capital improvements are considered fixed assets, and the cost of the improvement is expensed over the useful life of the improvement, while repairs and maintenance are expensed when paid or incurred. If the landlord makes tenant improvements, the capital expenditure is recorded as an asset on the landlord’s balance sheet.

If you originally paid this expense out of pocket and have not previously recorded it, add the amount to owner’s equity. Tangible assets are physical assets, such as land, buildings or equipment. Depreciation is calculated using the useful life of the asset and the salvage value, or the amount for which the asset can be sold at the end of its useful life. To start tracking your fixed assets, click the Item button at the bottom of the list and add the details for each asset. According to Dictionary.com, a Fixed Asset is a permanently owned item.

SiteOne Landscape Supply, Inc. (SITE) Q3 2022 Earnings Call … – Seeking Alpha

SiteOne Landscape Supply, Inc. (SITE) Q3 2022 Earnings Call ….

Posted: Wed, 02 Nov 2022 07:00:00 GMT [source]

Use clearing accounts when you cannot immediately post payments to a permanent account. For example, if you are furnishing a new building for a client, you may place costs and payments in a clearing account until the work is complete. If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account. Below are the most frequently asked questions concerning fixed asset accounting, as well as the concise, clear answers you’re seeking. Forget insurance recordkeeping requirements when recording and tracking fixed assets.

Goodwill Impairment Testing

Content

Unlike US GAAP, IFRS Accounting Standards do not limit the amount of impairment loss to the carrying amount of goodwill. The fair value of a reporting unit is measured in accordance with the fair value measurement topic .

EVOLENT HEALTH, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – Marketscreener.com

EVOLENT HEALTH, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Fri, 24 Feb 2023 22:17:10 GMT [source]

Therefore, the Company should assess whether a triggering event has occurred as of June 30th. The Company’s estimate of future cash flows for the reporting unit may involve the preparation of a single set of future cash flows or multiple sets of cash flows representing various possible scenarios which are then probability weighted to derive a single value. If using a single set of future cash flows, the discount rate should be adjusted to incorporate the uncertainty in expectations about the future cash flows, which will generally result in a higher rate reflective of the inherent risk. Conversely, a probability-weighted cash flow analysis already incorporates assumptions about the uncertainly in expectations about the future cash flows, and thus the discount rate should be commensurate only with the risk inherent in the reporting unit’s underlying business. Companies should include a terminal value at the end of the discrete projection period of a discounted cash flow analysis to reflect the remaining value that the reporting unit is expected to generate beyond the projection period. The terminal value represents the present value in the last year of the projection period of all subsequent cash flows into perpetuity, and reflects a stable long-term growth rate. We generally believe that a growth rate consistent with expected inflation and gross domestic product growth in the terminal year is appropriate for most entities, and a rate that exceeds expected inflation and GDP growth would be rare.

Annual improvements — 2006-2008 cycle

A simultaneous equation is required to adjust the goodwill impairment and deferred tax impact when tax deductible goodwill is present. Effective coordination between accounting and tax professionals will help appropriately reflect goodwill and deferred tax balances in the financial statements. A pivotal element of the goodwill impairment analysis is valuation, the quality of which depends upon the quality of the projections. Due to the prevailing uncertainty, many companies had to rethink their approach to valuation as it relates to goodwill impairment. For companies whose “cushion” (that is, the excess of the reporting unit’s fair value over its carrying amount) decreased from historically high levels, the monitoring needs and level of rigor went up. For instance, a company with a lot of cushion in the past may have been required to go back to the drawing board and build a fresh set of projections.

- To address these concerns, some financial statement preparers recommended, among other suggestions, that the Board allow an entity to use a qualitative approach for testing goodwill for impairment.

- Users of financial statements should consider these key differences when comparing financial results of similar companies.

- In the event that the recoverable amount had exceeded the carrying amount then there would be no impairment loss to recognise and as there is no such thing as an impairment gain, no accounting entry would arise.

- The impairment loss does not exceed the total of the recognised and unrecognised goodwill so therefore it is only goodwill that has been impaired.

- Significant changes to the dynamic of the financial services sector in recent years have shifted the paradigms in how we work.

- Therefore, if the unit difference under the new guidance is higher or lower than the goodwill difference, it will replace the goodwill difference, which may create a higher or lower goodwill impairment charge.

The Board received input from preparers of nonpublic entity financial statements indicating concerns about the cost and complexity of performing the first step of the two-step goodwill impairment test required under Topic 350, Intangibles–Goodwill and Other. To address these concerns, some financial statement preparers recommended, among other suggestions, that the Board allow an entity to use a qualitative approach for testing goodwill for impairment. As per generally accepted accounting procedures, self-generated goodwill is not to be recognized in accounts; only the purchased goodwill is to be recognized in the accounts.

Goodwill Impairment Study: Canadian Edition

The https://intuit-payroll.org/ arising is calculated by matching the fair value of the whole business with the whole fair value of the net assets of the subsidiary to give the whole goodwill of the subsidiary, attributable to both the parent and to the NCI. Following the revisions to IFRS 3, Business Combinations, in January 2008, there are now two ways of measuring the goodwill that arises on the acquisition of a subsidiary and each has a slightly different impairment process. Private companies in the US may elect to expense goodwill periodically on a straight-line basis over a ten-year period or less, reducing the asset’s recorded value. Goodwill impairment is an accounting charge that is incurred when the fair value of goodwill drops below the previously recorded value from the time of an acquisition.

- And provides background on changes integrated by the FASB in recent years including the recent Update.

- The quantitative impairment test is required if the Company concludes that it is more likely than not that a reporting unit’s fair value is less than its carrying amount or if the Company elects to skip the Step 0 assessment for a particular reporting unit.

- Goodwill impairment arises when there is deterioration in the capabilities of acquired assets to generate cash flows, and the fair value of the goodwill dips below its book value.

- Under the new guidance, if the equity premise is used for a reporting unit with a negative carrying amount, the reporting unit cannot have an impairment since the reporting unit’s fair value will always be greater than its carrying value.

An Goodwill Impairment would be required to perform that reassessment for as long as the entity would otherwise be required to disclose information about the subsequent performance of the business combination. In passing, you may wish to note an apparent anomaly with regards to the accounting treatment of gross goodwill and the impairment losses attributable to the NCI. This means that goodwill is $40 greater than it would have been if it had been measured on a proportionate basis; likewise, the NCI is also $40 greater for having been measured at fair value at acquisition. The impairment loss will be applied to write down the goodwill, so that the intangible asset of goodwill that will appear on the group statement of financial position, will be $100 ($300 – $200). The impairment review of goodwill is really the impairment review of the net asset’s subsidiary and its goodwill, as together they form a cash generating unit for which it is possible to ascertain a recoverable amount. The impairment loss will be applied to write down the goodwill, so that the intangible asset of goodwill that will appear on the group statement of financial position will be $270 ($300 – $30). The recoverable amount is, in turn, defined as the higher of the fair value less cost to sell and the value in use; where the value in use is the present value of the future cash flows.

IFRS Accounting

The entity may amortize goodwill over a shorter period if it can demonstrate that a shorter useful life is more appropriate. The amortization of goodwill will eventually reduce the carrying amount of an organization’s goodwill asset so much that goodwill impairment will be quite unlikely, thereby reducing the need to spend time on such testing. Companies need to perform impairment tests annually or whenever a triggering event causes the fair market value of goodwill to drop below its carrying value. Some triggering events that may result in impairment are adverse changes in the economy’s general condition, increased competitive environment, legal implications, changes in key personnel, declining cash flows or a situation where assets show a pattern of declining market value. Because many companies acquire other firms and pay a price that exceeds the fair value of identifiable assets and liabilities that the acquired firm possesses, the difference between the purchase price and the fair value of acquired assets is recorded as goodwill. However, if unforeseen circumstances arise that decrease expected cash flows from acquired assets, the goodwill recorded can have a current fair value that is lower than what was originally booked, and the company must record a goodwill impairment.